18 September 2018

Written by: Wesley Kozera, Business Development Manager, Geomant.

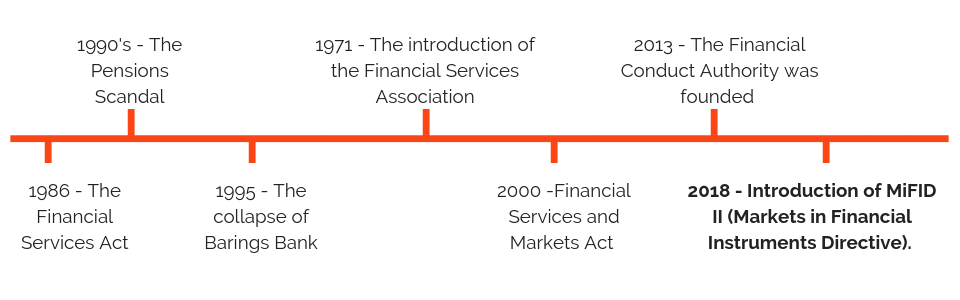

It’s vital for businesses to understand their obligations when it comes to the law and the financial services sector is no exception. There have been many changes in the last few decades that have been brought about to ‘tighten up’ controls in the industry. In this blog, we explore these changes, the reasons behind the transitions and look at where we are today with the most recent introduction of MiFID II (Markets in Financial Instruments Directive).

So, what’s changed? Let’s take a brief look into the history of the financial services industry.

Regulation of the financial services industry is not a new phenomenon. The Financial Services Act of 1986 marked a step change in the law of the UK financial services industry, widely recognised as the introduction of the modern regulatory system we see today. However, this relied on financial services organisations “self-regulating”.

The pensions scandal at the beginning of the ‘90s and the collapse of Barings Bank in 1995 ushered in the era of the FSA (Financial Services Association) and brought an end to self-regulation.

Then the introduction of the Financial Services and Markets Act in 2000 resulted in the implementation of statutes and regulations that would be supervised by an increasingly large and powerful FSA.

The financial crisis resulted in a significant restructuring of the regulatory framework, which ultimately caused the break-up of the FSA and the creation of a new and improved regulatory body, the FCA (Financial Conduct Authority).

The FCA implemented a new series of regulations backed by significant fines for those organisations that did not comply. For example, in 2017 the FCA levied penalties of £229,515,303, the largest single fine being £163,076,224 for a Tier 1 Investment Bank.

Where are we today?

The latest regulatory instrument to be implemented by the FCA is MiFID II, which came into place in January 2018. Organisations that do not comply can risk fines up to 5,000,000 Euros, or 10% of global turnover. It's estimated that 40% of financial services firms do not have suitable processes and technology in place to capture, record and consequently retrieve real-time business communications, putting them at risk of non-compliance with MiFID regulations, research shows. - http://www.internationalinvestment.net/regulation/40-of-financial-firms-at-risk-of-mifid-fines/

If you want to get a handle on this new regulation, the Geomant Guide to MiFID II details the requirements for compliance and demonstrates how, with Verint-Verba Compliance Technology, organisations can ensure current and future compliance. As a key distributor of Verint-Verba technologies, Geomant is uniquely positioned to support customers on this journey. Download your free guide below.